Dec 9, 2017 | Home and Environment, Wealth & Money

A couple of months of crazy days have seen us eating some “creative” meals of late.

My main focus has been to feed us reasonably healthy meals that do not require too much in the way of preparation or fuss. Some days there may have been time to do things like cook a roast for a couple of hours. Other days were “we need to eat in the next 30 minutes” type days.

We very rarely eat takeaway, as mostly we find we can do better at home, cheaper, faster and healthier. We do however look to fast food for concepts. I have seen some blog/Facebook groups that term this as “Fake-away” or “Takeaway at Home”.

Often our version of fast food turns into a “clean out the fridge special”. Some “recipes” for Clean out the Fridge specials are…

- A packet of mince ( which we buy in bulk and freeze in 250g pieces, whatever veggies are in the fridge simply chopped and fried together with a bit of beef stock made from powder and a dollop of tomato paste gets a tin of tomatoes added and simmered for 15 minutes or so while some pasta cooks. This creates a satisfying meal on the table in well under 30 minutes and reduces wasted food.

- A similar dish can be done with veggies and a cheese sauce added to a tin of tuna and pasta or rice.

- Veges sauteed with a bit of butter or oil and add some chunks of beef, lamb or chicken. Pour over 2 cups of water with a tablespoon of gravy powder, add any herbs you like and simmer until the meat is pull-apart tender. This one might take about 50 minutes to an hour.

Other ideas for “Fake-away” meals include..

- Make your own pizzas. This is great for using up leftover deli meats. You don’t even need a “proper” pizza base for these. Put two pieces of bread in the toaster together so that just one side of the bread gets toasted. Spread some tomato paste or sauce onto the untoasted side. Pile the toast nice and high with yummy toppings and sprinkle over some tasty cheese. Pop them under a hot grill until the cheese is melted and brown. Cut each slice of “pizza” into 2 and serve.

- Fish and Chips are a good standby to have in the freezer. Frozen crumbed fish fillets and frozen chips are simply put in a preheated oven for 25-30 minutes and “voila” dinner in half the time it would take to drive to the takeaway, wait for the order and drive home.

- Burgers are easy to make with either rolls or bread. Serve with chips from the oven

While all of these ideas are fast and affordable, the easiest way to have superfast meals ready to go is to always cook far more than you need and have meals ready to go in the freezer. We have always got something for those days when we really just could not bother.

What are your favourite “Fast, Fuss Free” meals??

Dec 7, 2017 | Personal Development, Vision Board, Wealth & Money

Did you read my recent post on what “they” say is the amount of money needed to retire? (it is here)

Did you read my recent post on what “they” say is the amount of money needed to retire? (it is here)

When this was originally reported, I said to my husband, “I am sure we could live on the pension as well as Mum & Dad.”

So, we decided to try it. Before making any sort of budget, I tracked our spending for 3 months to see exactly what we were spending, it was surprisingly low.

For our “live on the pension plan” we have not taken into consideration our mortgage or my husband’s car. We are working on the assumption that, like our parents, our home will be fully paid off and we will have just one car, which we will have no debt on, but will need funds to update regularly.

Every week I allocate the correct amount of cash for our budget needs within the confines of only having the amount for the current aged pension for a couple to live on. Bills are direct deposited to their relevant accounts (eg: I send $50 per week to our council for Rates, $50 a week to the Power company etc)

We have lived this way for the past 3 years or so and have not felt we have missed out on much at all. By not spending, we have seen a huge reduction in our debts. (BONUS)

This has spurred us on further to keep going with “living on the pension” for the next few years. We are aiming to be completely debt free in the next 2 years and then sell our businesses and be able to retire early. This of course will require a fairly decent amount of money in the bank, as we are both quite a way off being able to receive the actual pension.

My life of living a “Champagne Life on a (lite) Beer Budget” has been heavily worked with this way of living. Both my husband and I have our own businesses and they both do very well. From the outside, it appears we might splash the cash around quite readily, but in reality, we live within our “pension” budget.

I drive a new BMW which my business provides the funds for, there is money put aside in the “pension” budget to upgrade the car. Hubby’s business has work utes that we do not spend a lot on, as they are – well – work utes!

We plan on updating the BMW as often as we can well into retirement. We have found that the price of updating while the car has low mileage and is reasonably “new” is quite affordable and within our budget, especially when spread out over 3 years or so.

I love to travel, but our businesses are such that we can really only get away for the odd weekend, Easter and Christmas. I often find great deals for weekends away on daily deals sites that allow us to get away at a reasonable price. I also keep an eye on the airline deals and have been able to snag great deals on flights.

We both enjoy eating out and have a subscription to the Entertainment book each year. Using the vouchers, we can eat at more expensive restaurants than we would normally for half price. We also enjoy cooking, looking at restaurant menus and cooking similar meals at home for a fraction of the cost makes for an afternoon of culinary fun at home. A well stocked pantry and a good bulk butcher nearby, keep our grocery budget at a manageable level. It is the “grocery” section of the budget that I often find has a built-up surplus. This surplus gets either transferred to savings or put aside for meals out.

Like our parents, we do not “need” anything, so when asked what we want for a gift on birthday and Christmas, I often ask for experience type gifts. Vouchers for cafes, spa treatments etc are happily accepted.

The lessons we have learned from living within the pension amount is that, for us, it is achievable without any huge sacrifices. Our budget does not include any pension discounts from expenses such as utilities, registration, rates etc, so those will be bonuses if we receive them. We are blessed with good health and are conscious that chronic illness which requires long periods of expensive medications would be a burden on the budget.

Why not look at your own budget and decide if you could live on the pension?

Nov 29, 2017 | Vision Board, Wealth & Money

Quite some time ago I read a news report debating whether or not the Australian aged pension is “enough” to live on in today’s economy.

As expected, the comments were mixed with a lot of people saying they can NOT live on the amount received from the government.

(I must admit, I do find it amazing when I see these types of reports where we see a woman complaining that she does not have enough money for electricity to keep warm, but she is being interviewed in a thin cotton top. – Put a jumper on!!)

Both my parents and my in-laws are retired, and I have seen them live a happy and activity filled retirement over the last 15-20 years. They are not having any trouble at all living successfully on the pension. My parents are in between the “modest” and “comfortable” categories and just simply cannot spend it all. In-laws are on the aged pension only and live as well as we do, if not more socially. My Father recently passed away and Mum is now on a single pension with a small superannuation top up, and still, the bank account keeps rising.

The number one thing I have noticed that has led to living comfortably on the pension is to own the roof over your head. Most reports show that housing is the number one cost for retirees. Retiring with no debt, a small nest egg and a low maintenance home has shown itself to be a huge benefit to both sets of parents.

Also, retirement is not all about how much money you have. How many of us “young’uns” just wish for time to do what we want? Retirees will often say, they don’t know how they had time to work. Gardening, craft, and reading a good book or magazine are things that often get somewhat neglected in the hustle and bustle of a busy working life.

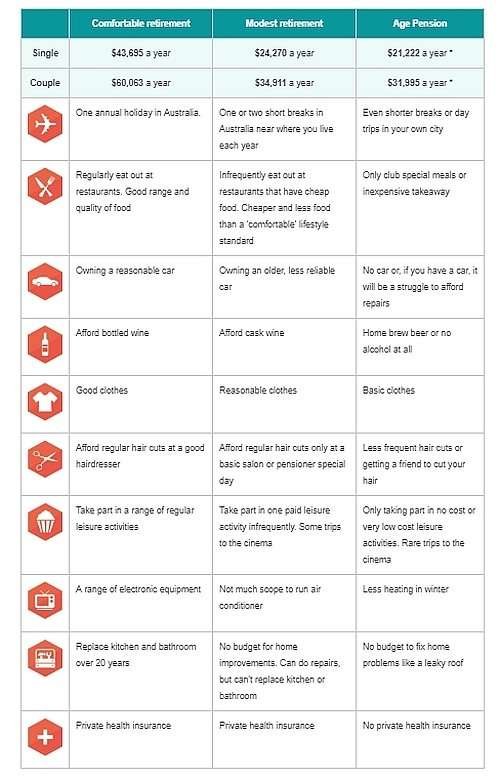

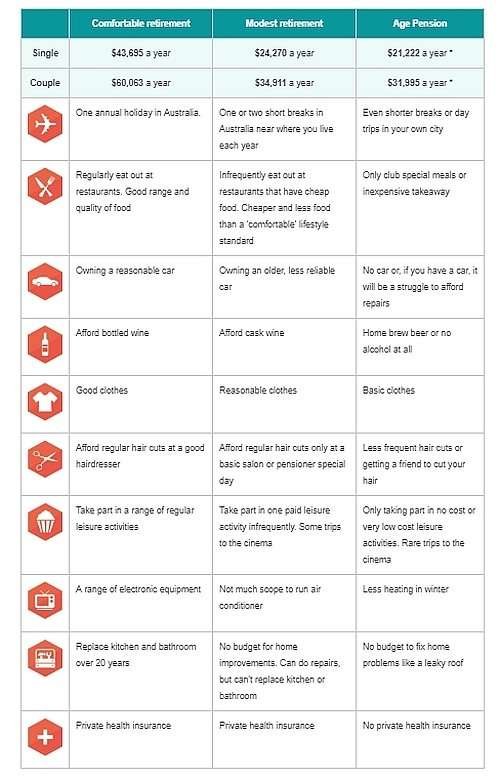

This table proposes the amounts supposedly needed for varying levels of retirement.

https://www.superguru.com.au/retiring/how-much-super-will-i-need

One thing that the “gurus” neglect to think of is peer groups.

If retirees are surrounded by other high income retirees who travel overseas often then yes, they may need a much higher figure.

My parents were in a caravan club so they travelled quite extensively. They are not interested in international travel (apart from NZ where we have some family – does NZ even count as international???)

The in-laws love train travel and have done the

Spirit of the Outback a few times We looked at doing the Outback with them one trip but without the pensioner discount it is REALLY expensive.

Both parents eat out ALL THE TIME. We regularly get an answering machine because they are out to dinner. Usually clubs, but certainly not restricted to the “seniors specials”, because that is what they like to eat. None of them are into “towers of no food” as my Dad called “better” restaurants.

Both Mothers have overflowing pantries that we joke will feed us for years when we eventually have to clean out the houses. Regular catch ups with friends over a new cake or biscuit recipe and a cuppa are commonplace.

Both parents have always had late model cars that are regularly maintained. Because of the van, Dad had a fairly new 4×4, and since his passing, this has been sold. Mum does not drive so that vehicle expense is now partly taken up with community bus fares. The in-laws have not long upgraded their car to a late model small 4cyl Toyota.

All drink bottled wine bought beer, spirits, sherry and port.

Clothes, the men are men and don’t really care. The Mums just buy clothes and they wear them. The Mothers are both well dressed from Rockmans, Millers, Noni B etc so reasonable clothes. (Although neither woman was a “designer clothes” wearer)

All get their hair cut at local hairdressers and look neat and tidy at all times.

As mentioned previously, they have active social lives filled with leisure activities. Cinema outings, meals with friends and craft group outings feature regularly on the calendar.

The houses are both fully owned, modern homes that are standard 4/2/2 and are in good condition. Neither house will need new kitchens or bathrooms in their lifetime.

Neither have health insurance and have not needed it. There has been some serious illness (1 cancer, 2 diabetics, 1 aortic aneurism op) and of course, all have glasses. The public system has been FANTASTIC and none of us can complain about the quality or timeliness of treatment. In the last year of Dad’s life, he had multiple trips to the hospital and weekly visits to his GP, all in the public system. Nothing could have been done any differently in the Private system to make his last year any different.

Watching our parents age has been a wonderful learning experience for my husband and I. We are not worried about our level of comfort in retirement at all. We are working on setting ourselves up now, and look forward to our golden years.

Nov 11, 2017 | Personal Development, Wealth & Money

I must admit I like to read but I rarely make myself enough time to get lost in a novel 🙁

I do, however, enjoy a magazine regularly.

Over the course of the years, family members have gifted me subscriptions to magazines, such as Better Homes and Gardens, Gourmet Traveller, Women’s Weekly and a few recipe/food magazines. Once the subscription was over, sometimes I continued it myself or just bought the magazine from the supermarket.

One day it dawned on me that magazines are EXPENSIVE!! and are probably not very environmentally friendly with all that gloss paper, toxic inks and disposal after a very short time.

I found that our library had a good range of magazines, but they were often months behind, even the digital versions were sometimes 2 or 3 months behind the current issue 🙁

I did subscribe to some of my favourites with iSubscribe. For a while, this was a good option that saw current editions land on my iPad regularly. While there are good savings to be made, it is still a luxury.

Today my reading prayers have been answered!! Groupon has a fantastic deal that will see me with as many digital magazines as I can possibly digest in one year for just $29.99

I had not heard of this company, Magzter, before but I am super impressed with the range of titles, there are 1000’s of them.

I have signed up, downloaded the app to my iPad and might spend the rest of the weekend, “flipping” through magazines.

Sep 15, 2017 | Fun & Recreation, Romance, Wealth & Money

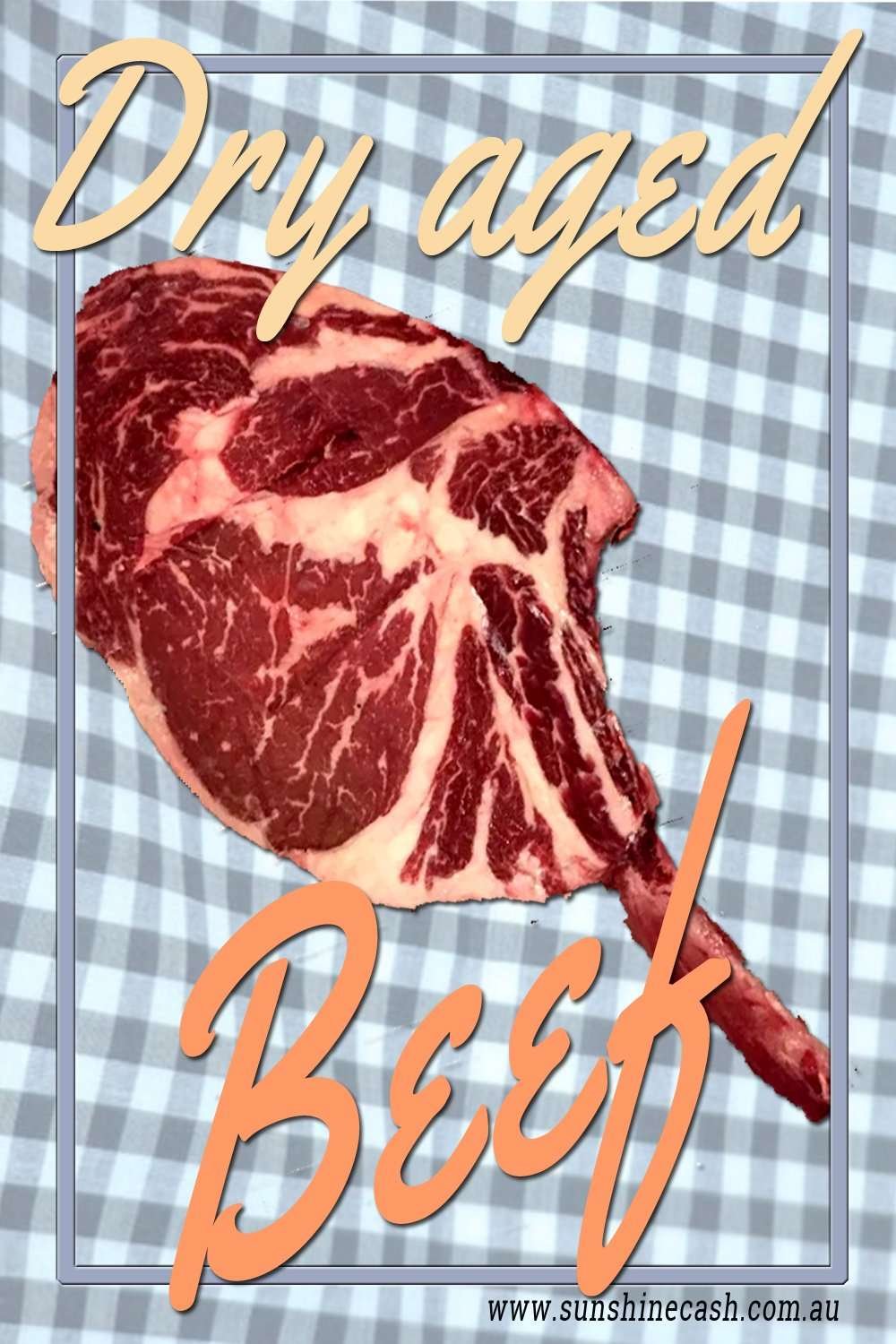

Have you ever had Dry Aged Meat?? Hubby and I were aware that some high-end butchers dry-aged meat, but we had never seen it let alone eaten it.

Have you ever had Dry Aged Meat?? Hubby and I were aware that some high-end butchers dry-aged meat, but we had never seen it let alone eaten it.

What is Dry Aged Meat? According to Wikipedia

| “Dry-aged beef is beef that has been hung or placed on a rack to dry for several weeks. After the animal is slaughtered and cleaned, it is hung as a full or half carcass. Primal (large distinct sections) or sub primal cuts, such as strip loins, rib eyes, and sirloin, are placed in a refrigerator unit, also known as a “hot box”. This process involves considerable expense, as the beef must be stored near freezing temperatures. Subprimal cuts can be dry aged on racks either in specially climate-controlled coolers or within a moisture-permeable drybag. Moreover, only the higher grades of meat can be dry aged, as the process requires meat with a large, evenly distributed fat content. Because of this, dry-aged beef is seldom available outside of steak restaurants and upscale butcher shops or groceries. The key effect of dry aging is the concentration and saturation of the natural flavour, as well as the tenderization of the meat texture.” |

I noticed on Facebook recently that Cotton Tree Meats not far up the road from us had installed a dry aging cabinet. The reviews were that the meat was something that had to be tasted to be believed.

When my birthday rolled around in August, hubby asked me what I wanted for my birthday, and where would I like to go out for dinner. I suggested a “2 for 1” present and said why not buy a piece of dry aged beef?

A short trip later and we were the proud owners of the most beautiful looking piece of 28-day dry aged Black Angus Rib-eye on the bone.

We like to think we are pretty capable cooks, but we thought we had better find out how to do this lovely steak true justice. The answer turned out to be a cooking technique we had not tried before. “Reverse Searing”

Reverse Searing is a method that involves slow cooking the steak in a super low oven until the internal temperature reaches the desired doneness, then finishing in a screaming hot pan to give a lovely seared crust.

This method works best with a thick piece of steak so have your butcher cut a nice piece of Sirloin, Rib, Rump or T-bone into at least 50mm thick (this will feed 2-3 people).

This is the step by step method.

Step 1:

Pre-heat your oven to 135º C

Step 2:

Pat your piece of steak dry with paper towel. (the drier you can get the

steak the better the crust you will get)

Season well with salt and pepper. (there is no need to oil the meat)

Step 3:

Place the meat on a grill over a baking pan lined with foil or baking

paper to catch any drips.

Step 4:

Bake in the oven until the internal temperature of the meat reaches your

required doneness. Do NOT guess this, invest in a meat thermometer.

Remove from the oven and rest under foil for at least 10 minutes.

Step 5:

Get a heavy frying pan (cast iron is good) or BBQ screaming hot and add

a couple of tablespoons of vegetable oil to the pan. Carefully place the steak in the pan and sear well for 1- 2 minutes on each side, don’t forget the edges until a lovely golden crust forms.

Step 6:

Place your steak on a board and cut it into pieces diagonally across the grain. Serve simply with a bit of herbed butter or your favourite sauce.

This was certainly NOT a budget meal, but still much less than if we had gone to a local pub and had a standard steak, salad and chips meal. And of course, it was sooooooo much nicer .

Next time you get a piece of steak, do try this method of cooking. It might

just change your life 🙂

Apr 18, 2017 | Free Resource, Wealth & Money

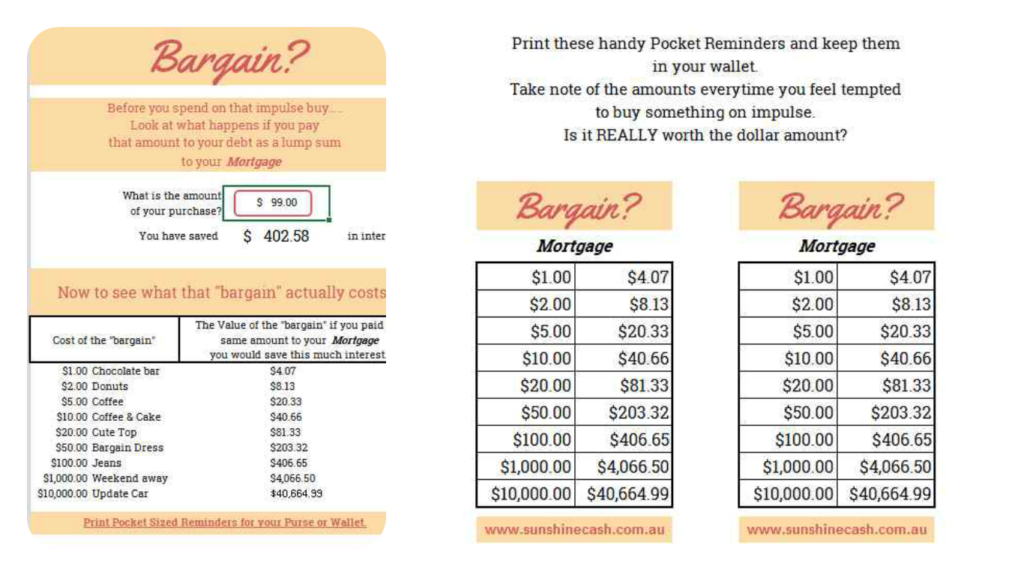

Who hasn’t been in this scenario?

It is the day after payday, you have a party to go to on the weekend, and you really need a new dress. (shoes, bag, coat etc)

You go to the mall and “BARGAIN” you find the perfect top for just $20. YAY!!!! At the same shop, you find a cute skirt, a shirt for work and a funky belt.

You walk out of the store feeling really good that you got some great deals. All that for just $99.00

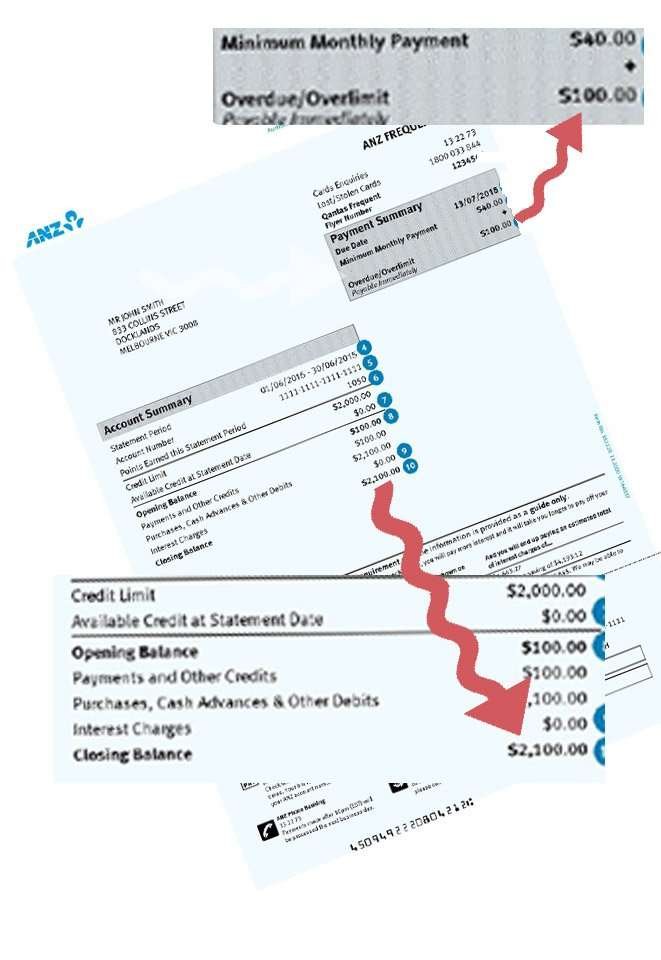

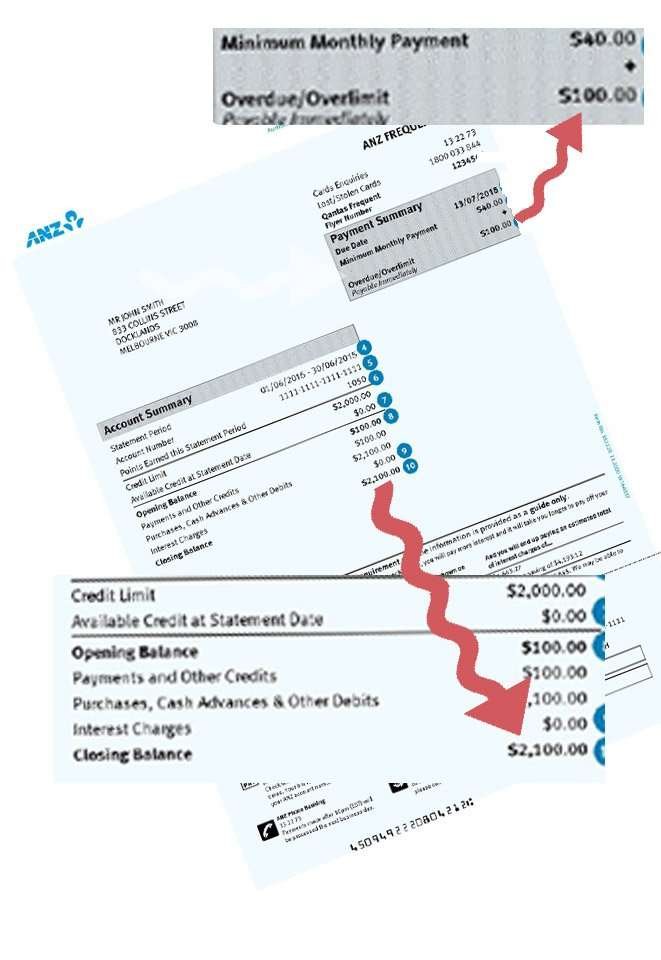

Still on a high, you get home, check the mail, and UH-OH the credit bill is in 🙁 (bummer) A quick glance at it and you see that you are only slightly overdrawn, but you are pretty happy that the balance is only $2100.00, and the bill is only $140.00.

Before you get too comfortable in thinking all is good in your “debt world”…What if I was to tell you that your $99.oo “bargains” might be actually costing you over $2000??? HOW CAN THIS BE???

It is because of the power of compounding interest. The same superpower that makes rich people richer also works in reverse to help keep you drowning in debt.

Consider this…

Do you just pay the minimum payment on your credit card? Have you had that same card for YEARS and still owe the same amount? Do you have ANY idea when you will pay it out? Let me let you in on a secret…The bank does NOT want you to pay it out!!! You are a veritable cash cow for them. Have a look over your statement, somewhere you should find a panel that shows how long it will take to clear your debt if you just paid the minimum payment.

In our example above, we can see that paying just the minimum payment, it will take 19 years to clear this $2100, and you will pay $4600 in interest as well. Are you feeling a little sick right now? Are you wishing you hadn’t spent that $99.00?

What if I was to make you feel better by giving you a handy tool that shows you how much you could save by paying any amount off your credit card, mortgage, personal loan or car loan?

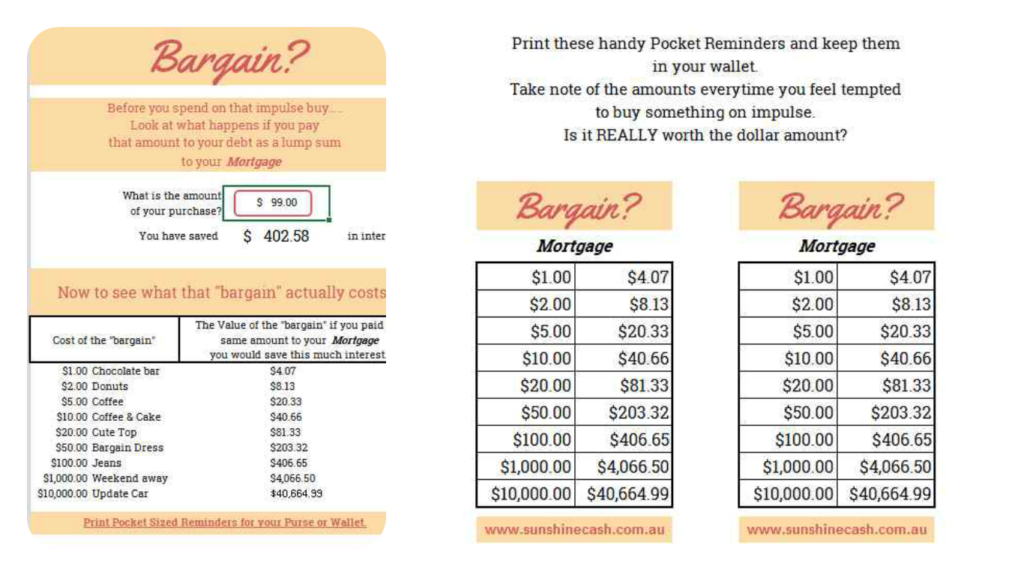

I have created a super easy to use excel spreadsheet that calculates the value of paying extra toward your debt. As long as you know the amount owing, the interest rate and the time left on your loan, you can have an accurate gauge as to the real cost of any “bargain” you are considering buying.

This method has been one of the cornerstone ways we have been able to create our Champagne Lifestyle. By really deciding if a purchase was worthy enough to buy or have that same amount clearing the most expensive debts we were able to be debt free in a few short years.

Access the FREE basic Loan Calculator HERE

(the download will be a .zip file, you will need to unzip it to find the excel file inside)

In this screen shot, you can see on the left, we have entered the Loan Amount (the balance of our credit card -$2100), the Interest Rate ( also found on the credit card bill) and the Loan Period ( the time to pay out if we just paid the minimum required) Over on the right you will see two areas to calculate the difference if you were to pay a regular amount with each payment or a Lump Sum- one off payment. You can see, I have entered the $99.00 “bargain” shopping spree. If you would have paid that $99.00 off the credit card along with the regular bill, you would have saved over $2000 in interest.

Want a reminder tool?

Purchase the PLUS version of the calculator for a tiny $1.99 and it will provide you with a reference table showing how much you could save by not spending. Based on the details placed in the first table, this next sheet calculates the amount of often purchased items. Also included are handy pocket sized printable tables to remind you of the power of paying your debt down rather than spending. When I needed to pay off a large credit card debt, I wrapped the table around my card, so everytime I went to use the card I was reminded. It really does work to rethink your purchases.

*Disclaimer. This calculator is for general use only, I am not an accountant or financial planner. Please check with your own bank to determine the exact figures.

Purchase now and get instant access for just $1.99

Did you read my recent post on what “they” say is the amount of money needed to retire? (

Did you read my recent post on what “they” say is the amount of money needed to retire? (

Quite some time ago I read a news report debating whether or not the Australian aged pension is “enough” to live on in today’s economy.

As expected, the comments were mixed with a lot of people saying they can NOT live on the amount received from the government.

(I must admit, I do find it amazing when I see these types of reports where we see a woman complaining that she does not have enough money for electricity to keep warm, but she is being interviewed in a thin cotton top. – Put a jumper on!!)

Both my parents and my in-laws are retired, and I have seen them live a happy and activity filled retirement over the last 15-20 years. They are not having any trouble at all living successfully on the pension. My parents are in between the “modest” and “comfortable” categories and just simply cannot spend it all. In-laws are on the aged pension only and live as well as we do, if not more socially. My Father recently passed away and Mum is now on a single pension with a small superannuation top up, and still, the bank account keeps rising.

The number one thing I have noticed that has led to living comfortably on the pension is to own the roof over your head. Most reports show that housing is the number one cost for retirees. Retiring with no debt, a small nest egg and a low maintenance home has shown itself to be a huge benefit to both sets of parents.

Also, retirement is not all about how much money you have. How many of us “young’uns” just wish for time to do what we want? Retirees will often say, they don’t know how they had time to work. Gardening, craft, and reading a good book or magazine are things that often get somewhat neglected in the hustle and bustle of a busy working life.

Quite some time ago I read a news report debating whether or not the Australian aged pension is “enough” to live on in today’s economy.

As expected, the comments were mixed with a lot of people saying they can NOT live on the amount received from the government.

(I must admit, I do find it amazing when I see these types of reports where we see a woman complaining that she does not have enough money for electricity to keep warm, but she is being interviewed in a thin cotton top. – Put a jumper on!!)

Both my parents and my in-laws are retired, and I have seen them live a happy and activity filled retirement over the last 15-20 years. They are not having any trouble at all living successfully on the pension. My parents are in between the “modest” and “comfortable” categories and just simply cannot spend it all. In-laws are on the aged pension only and live as well as we do, if not more socially. My Father recently passed away and Mum is now on a single pension with a small superannuation top up, and still, the bank account keeps rising.

The number one thing I have noticed that has led to living comfortably on the pension is to own the roof over your head. Most reports show that housing is the number one cost for retirees. Retiring with no debt, a small nest egg and a low maintenance home has shown itself to be a huge benefit to both sets of parents.

Also, retirement is not all about how much money you have. How many of us “young’uns” just wish for time to do what we want? Retirees will often say, they don’t know how they had time to work. Gardening, craft, and reading a good book or magazine are things that often get somewhat neglected in the hustle and bustle of a busy working life.

This table proposes the amounts supposedly needed for varying levels of retirement.

This table proposes the amounts supposedly needed for varying levels of retirement.

Have you ever had Dry Aged Meat?? Hubby and I were aware that some high-end butchers dry-aged meat, but we had never seen it let alone eaten it.

Have you ever had Dry Aged Meat?? Hubby and I were aware that some high-end butchers dry-aged meat, but we had never seen it let alone eaten it.