Quite some time ago I read a news report debating whether or not the Australian aged pension is “enough” to live on in today’s economy.

As expected, the comments were mixed with a lot of people saying they can NOT live on the amount received from the government.

(I must admit, I do find it amazing when I see these types of reports where we see a woman complaining that she does not have enough money for electricity to keep warm, but she is being interviewed in a thin cotton top. – Put a jumper on!!)

Both my parents and my in-laws are retired, and I have seen them live a happy and activity filled retirement over the last 15-20 years. They are not having any trouble at all living successfully on the pension. My parents are in between the “modest” and “comfortable” categories and just simply cannot spend it all. In-laws are on the aged pension only and live as well as we do, if not more socially. My Father recently passed away and Mum is now on a single pension with a small superannuation top up, and still, the bank account keeps rising.

The number one thing I have noticed that has led to living comfortably on the pension is to own the roof over your head. Most reports show that housing is the number one cost for retirees. Retiring with no debt, a small nest egg and a low maintenance home has shown itself to be a huge benefit to both sets of parents.

Also, retirement is not all about how much money you have. How many of us “young’uns” just wish for time to do what we want? Retirees will often say, they don’t know how they had time to work. Gardening, craft, and reading a good book or magazine are things that often get somewhat neglected in the hustle and bustle of a busy working life.

Quite some time ago I read a news report debating whether or not the Australian aged pension is “enough” to live on in today’s economy.

As expected, the comments were mixed with a lot of people saying they can NOT live on the amount received from the government.

(I must admit, I do find it amazing when I see these types of reports where we see a woman complaining that she does not have enough money for electricity to keep warm, but she is being interviewed in a thin cotton top. – Put a jumper on!!)

Both my parents and my in-laws are retired, and I have seen them live a happy and activity filled retirement over the last 15-20 years. They are not having any trouble at all living successfully on the pension. My parents are in between the “modest” and “comfortable” categories and just simply cannot spend it all. In-laws are on the aged pension only and live as well as we do, if not more socially. My Father recently passed away and Mum is now on a single pension with a small superannuation top up, and still, the bank account keeps rising.

The number one thing I have noticed that has led to living comfortably on the pension is to own the roof over your head. Most reports show that housing is the number one cost for retirees. Retiring with no debt, a small nest egg and a low maintenance home has shown itself to be a huge benefit to both sets of parents.

Also, retirement is not all about how much money you have. How many of us “young’uns” just wish for time to do what we want? Retirees will often say, they don’t know how they had time to work. Gardening, craft, and reading a good book or magazine are things that often get somewhat neglected in the hustle and bustle of a busy working life.

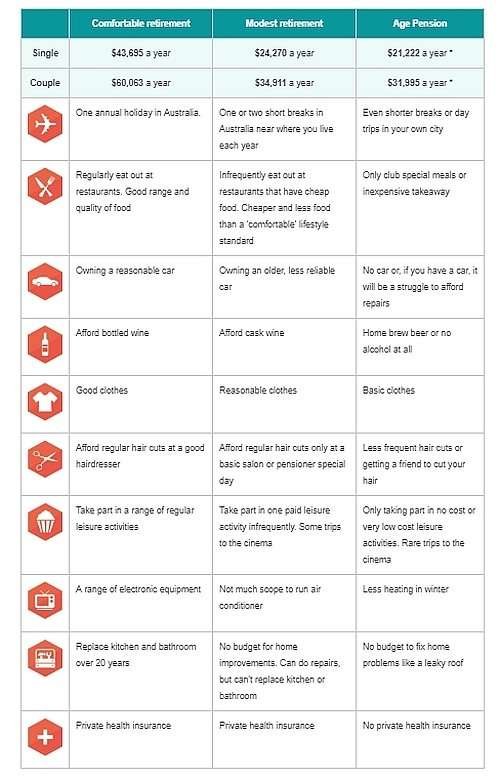

This table proposes the amounts supposedly needed for varying levels of retirement.

This table proposes the amounts supposedly needed for varying levels of retirement.

https://www.superguru.com.au/retiring/how-much-super-will-i-need

One thing that the “gurus” neglect to think of is peer groups. If retirees are surrounded by other high income retirees who travel overseas often then yes, they may need a much higher figure. My parents were in a caravan club so they travelled quite extensively. They are not interested in international travel (apart from NZ where we have some family – does NZ even count as international???) The in-laws love train travel and have done the Spirit of the Outback a few times We looked at doing the Outback with them one trip but without the pensioner discount it is REALLY expensive. Both parents eat out ALL THE TIME. We regularly get an answering machine because they are out to dinner. Usually clubs, but certainly not restricted to the “seniors specials”, because that is what they like to eat. None of them are into “towers of no food” as my Dad called “better” restaurants. Both Mothers have overflowing pantries that we joke will feed us for years when we eventually have to clean out the houses. Regular catch ups with friends over a new cake or biscuit recipe and a cuppa are commonplace.

Trackbacks/Pingbacks